- HostileCharts

- Posts

- The Message Of The Market

The Message Of The Market

It's Who I Trust

The Choice is YOURS

We all face the same choice in this world.

Succumb to problems, excuses, and the noise of others or take responsibility for our path.

Health. Wealth. Relationships.

The choice is the same: ownership or deflection.

That’s what drew me to technical analysis.

I no longer had to depend on someone’s hot take, a CEO’s spin, or the false conviction of holding through a 40% drawdown just because “the story is still good.”

Technicals gave me something better.

A direct line to the only source that matters. The Market.

Price isn’t just numbers on a screen.

It’s the collective judgment of millions of investors around the world.

No single person has all the wisdom, but price reflects the sum of it.

One stock can lie. A narrative can mislead.

But when you stack the evidence across breadth, trend, sentiment, and risk metrics, the message becomes clear.

That’s the difference between noise and a framework.

Breadth shows if participation is healthy or narrow.

Risk metrics show if investors are leaning risk-on or risk-off.

Inter-market analysis shows where flows are rotating bonds, commodities, currencies, equities.

Sentiment shows when the crowd is too euphoric or too fearful.

Put it together, and you get context that’s stronger than any single chart or opinion.

Breadth - “Market of Stocks” - Don’t Fight the Trend

Breadth is step one in my framework.

It tells us whether participation is broad or narrow.

This chart shows the percentage of stocks above their key moving averages.

From short-term (20-day) to long-term (200-day).

The takeaway is simple: across multiple timeframes, most major indexes are tilted toward strength.

If there was a reason to worry, it would first show up in the short-term averages and then bleed into the longer-term.

Right now, that worry doesn’t exist.

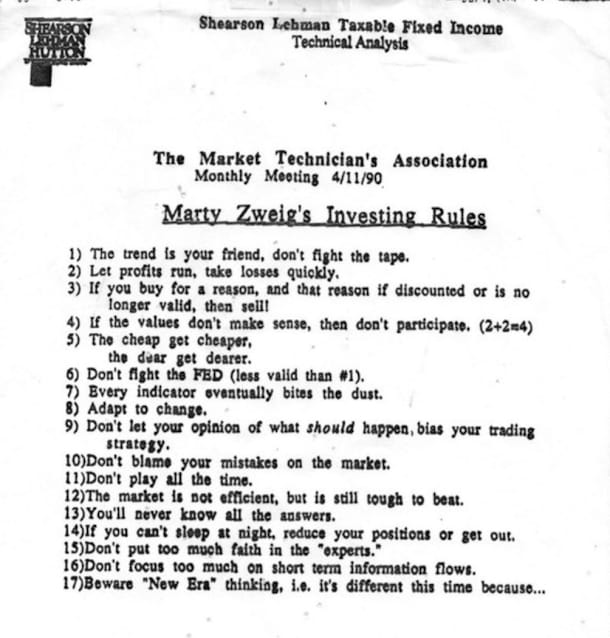

As legendary investor Marty Zweig said, the trend is your friend, don’t fight the tape.

Risk Metrics - It’s Healthy To Take Risk

Once breadth confirms participation, the next question is: what kind of risk is the market rewarding?

That’s where risk metrics come in.

Discretionary vs. Staples (Equal Weight).

When consumer discretionary outperforms staples, it signals investors are embracing offense over defense. Right now, discretionary is leading — money is flowing toward growth and away from safety.

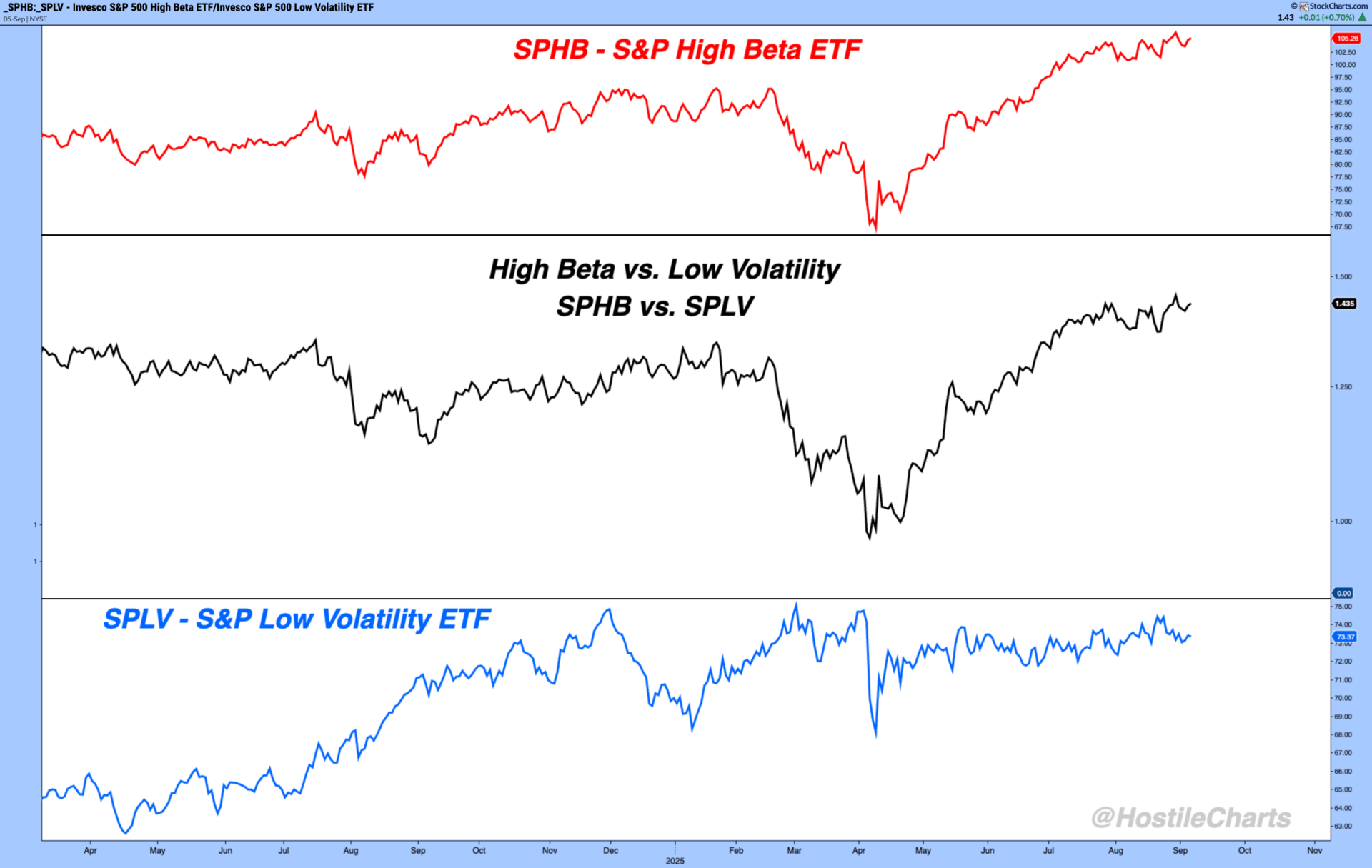

High Beta vs. Low Volatility (SPHB vs. SPLV).

Is the market rewarding risk-takers or the cautious crowd?

The ratio is pushing higher, meaning risk-taking is being rewarded.

If these relationships flip, that’s when we know risk appetite is drying up.

We saw that at the start of the year….price lets us know….

$RSPD vs. $RSPS - (Equal Weight )Discretionary to Staples already down 10% .... is the S&P 500 next $SPY?

— Larry Thompson, CMT CPA (@HostileCharts)

11:55 AM • Mar 9, 2025

But right now, the market is saying the opposite: risk is being rewarded.

Collective Wisdom In Charts

No single person has the answer, but the sum of their decisions shows up in the charts.

$XHB ( ▲ 0.9% ) $ITB ( ▲ 0.55% ) - Housing Stocks are a leading signal on housing demand and consumer strength. Their resilience tells us how the market is voting on the U.S. economy.

As you can see below, homebuilders warned us earlier this year.

$SPY $XHB $ITB - Can we have persistent new all time highs without the homies?

— Larry Thompson, CMT CPA (@HostileCharts)

7:13 PM • Feb 18, 2025

Price carries the wisdom to warn us when caution is needed.

Now they’ve caught up with the market, a healthy feature of bull markets.

$SPY $SMH $XHB $ITB - Homies are catching up.

Bull Markets Solve Problems.....

— Larry Thompson, CMT CPA (@HostileCharts)

11:57 AM • Sep 6, 2025

Biotech $IBB ( ▼ 0.37% ) - Biotechs are one of the riskiest corners of the market. When money rotates here, it reflects confidence and a willingness to embrace risk. New year to date highs is not exactly signaling caution.

$XRT ( ▲ 0.73% ) - Retail Stocks - I wrote a note on this earlier this week.

$XRT - An equally weighted Retail ETF with 90 companies closed at Multi-Year Highs Friday.

I think the market is giving us a clear message about the consumer......

— Larry Thompson, CMT CPA (@HostileCharts)

12:21 PM • Sep 6, 2025

Choose Wisely

The Choice Is Yours

Follow the message of the market or the narrative of men.

Right now, the message is clear. It’s a Bull Market.

When it changes, price will still be here to warn and guide.

Choose wisely.

My Weekly Show - Thompson’s Two Cents

🎥 Thompson Two Cents Live

🚀 Throw it on 1.5x speed and let it rip.

👍 Give it a like. It’s the easiest way to show me some love.

The Sunday Stalk List | Ep. 15

If you want clean charts, clear setups, and tactical insights — this one’s for you.

It hits inboxes every Sunday so you know exactly what to keep an eye on for the week ahead.

The early feedback has been 🔥 and we’ve already tagged some big winners.

I’m loving getting Larry Thompson’s Sunday Stalk List @HostileCharts. Nice clean delivery every week with great content. Amazing work all around @StockMktTV h/t Thompson’s Two Cents

— J.C. Parets (@JC_ParetsX)

7:48 PM • Jul 20, 2025

Cheers,

Larry Thompson, CMT CPA