- HostileCharts

- Posts

- It's...TIME

It's...TIME

Next Phase Of The Year End Rally

It’s…TIME

As Bruce Buffer bellows before every fight…

It’s… TIME! This video will get you hyped up

Time for the market to make a decision.

Over the past couple of weeks, mega-cap Tech has been landing all the punches.

As I wrote last week, the “risk” of concentration wasn’t to the downside — it was to the upside.

And that’s exactly how it played out.

Tech ripped higher, pulling the index to fresh all-time highs.

$SPY - Concentration is a risk...but not JUST to the downside.

$TOPT - (Top 20) - At All Time Highs

$XLG - (Top 50) - At All Time Highs

$OEF - (Top 100) - At All Time Highs— Larry Thompson, CMT CPA (@HostileCharts)

6:29 PM • Oct 26, 2025

Now, here comes the crowd noise: “Breadth is bad,” “It’s a melt-up,” “It can’t last.”

It’s always the same story.

When the market wins, but not the way people want, they call it a bubble or a top.

But this is the moment that defines every Bull Market.

When leadership has done the heavy lifting, and the rest of the field decides whether to step up.

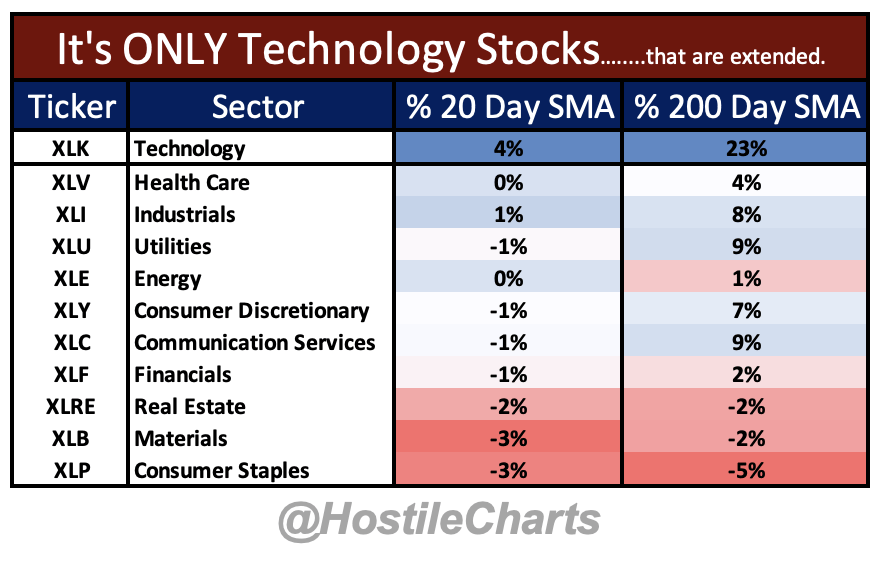

And here’s the truth: only one corner of the market is even “extended.”

Using distance from moving averages, we can quantify it.

Tech’s the only sector stretched by any real measure.

Everything else? Coiled, resting, or basing.

So as people argue whether Tech will “roll over to join the rest,”

the better question is when will the laggards catch up?

In Bull Markets, leaders don’t roll over — they pull others higher.

So yeah. It’s TIME.

Time for the rest of the market to catch up.

Breadth and Risk

I’m betting on catch-up, not collapse.

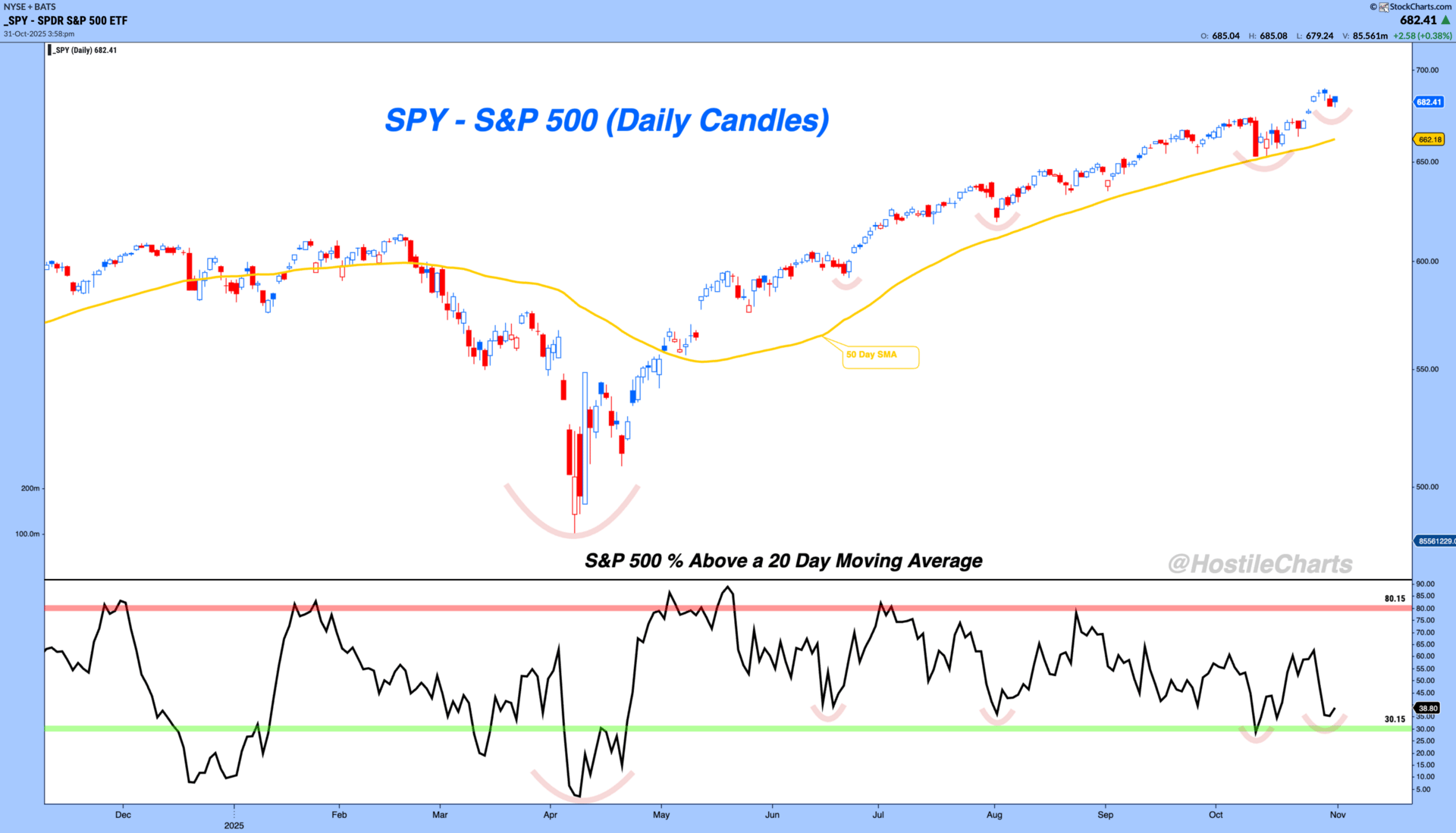

The percentage of S&P 500 stocks above a 20-day moving average is sitting near washout levels that have repeatedly preceded rebounds throughout this Bull Market.

Breadth Looks Ready To Rally

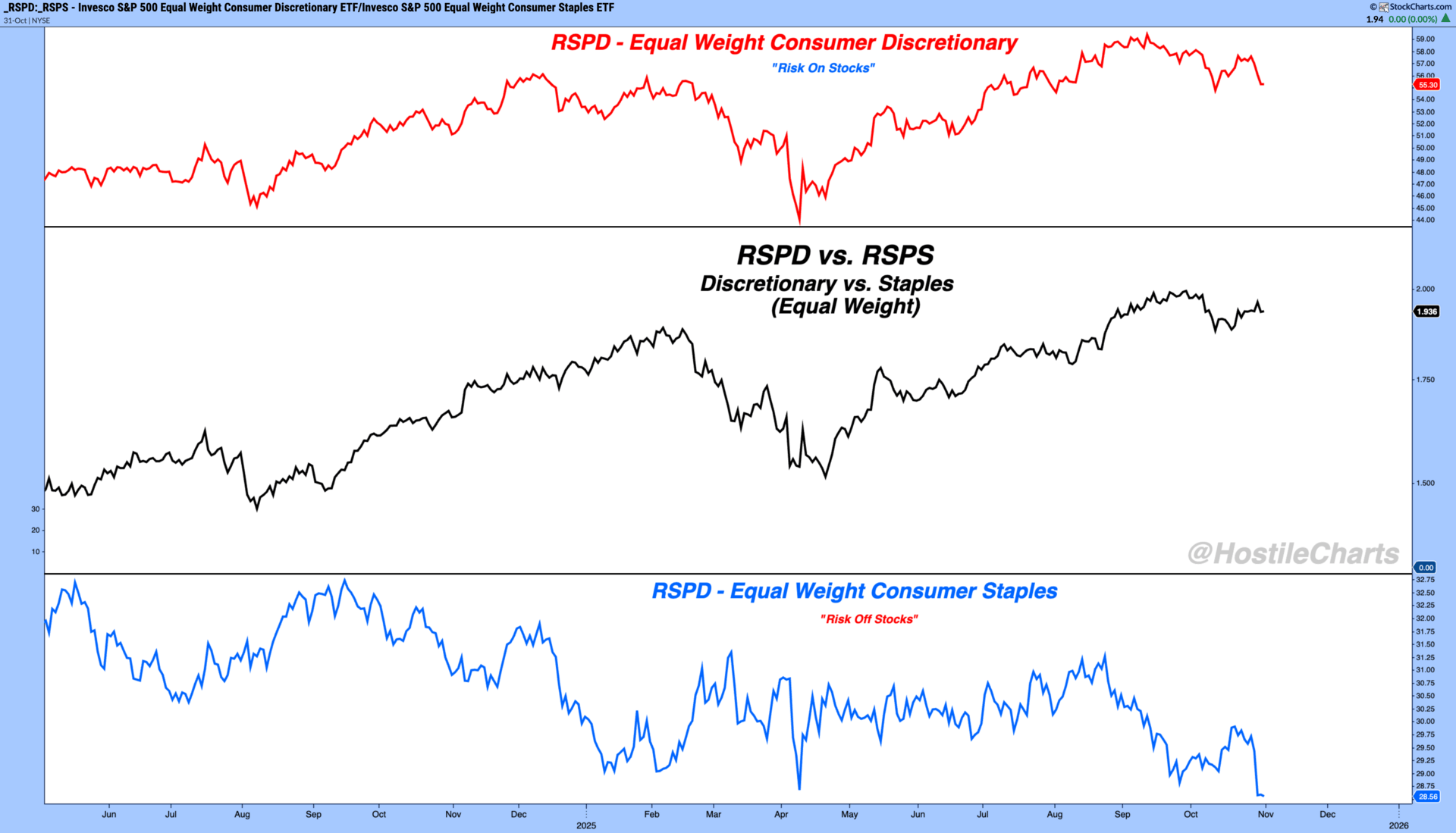

Risk metrics confirm it.

Equal-weight Consumer Discretionary continues to outperform Equal-weight Staples.

In simple terms, people are selling risk-off stocks at a faster rate than risk-on stocks.

That’s more indicative of the market catching its breath for expansion, rather than being ready to roll over from exhaustion.

The Setups

Okay, with this backdrop, I want to be buying offensive areas of the market that offer well-defined risk/reward.

Utilities (XLU) – Testing horizontal support and the 50-day moving average. I like adding strength here.

Financials (XLF) – Lagging Tech (like everything else), but sitting right on long-term support. If we rally into year-end, this is where exposure makes sense with clear risk levels.

Consumer Discretionary (XLY) – A classic cup-and-handle structure with a failed breakdown this week—saved by Amazon earnings. That low is your line in the sand.

Communication Services (XLC) – META earnings are out, and this group can now reset and grind back toward highs. I like this base around $117, using last week’s low as a short-term stop.

The Bull Market Mentality

Here’s the thing. We’re in a Bull Market.

The goal isn’t to invent problems to worry about.

It’s to recognize opportunity and manage risk.

In Bull Markets, things tend to go right. It just never feels wise to say that.

One of the best writers of this generation, Morgan Housel, put it perfectly:

Optimism often sounds like a sales pitch, pessimism sounds like someone trying to help you.

— Morgan Housel (@morganhousel)

2:34 PM • Apr 22, 2022

So, with that opportunistic mindset, we look for good setups.

The beauty of these setups is simple — you’ll know if you’re wrong quickly.

Risk is well-defined.

So with breadth washed out, positioning healthy, and leadership strong, it’s time to lean in.

Not blindly, but with intent.

It’s TIME to buy well-defined risk in the offensive parts of the market.

It’s TIME for this Bull Market to show who’s stepping into the ring next.

My Weekly Show - Thompson’s Two Cents

This week I breakdown the framework for the next leg higher in this Bull Market.

🚀 Throw it on 1.5x speed and let it rip.

👍 Give it a like. It’s the easiest way to show me some love.

The Sunday Stalk List | Ep. 21

If you want clean charts, clear setups, and tactical insights — this one’s for you.

It hits inboxes every Sunday so you know exactly what to keep an eye on for the week ahead.

I’m loving getting Larry Thompson’s Sunday Stalk List @HostileCharts. Nice clean delivery every week with great content. Amazing work all around @StockMktTV h/t Thompson’s Two Cents

— J.C. Parets (@JC_ParetsX)

7:48 PM • Jul 20, 2025

Cheers,

Larry Thompson, CMT CPA